Qatar B2B travel market is entering a new era of growth driven by strong economic development, major trade events, and rising international business activity. As the country continues to diversify beyond its energy sector, corporate travel has become a vital part of strengthening partnerships, attracting investors, and supporting large-scale infrastructure and technology projects.

The success of global events such as the FIFA World Cup 2022 has significantly raised Qatar’s profile as a premium destination for business travel. Coupled with the expansion of Hamad International Airport and Qatar Airways’ global network, the country is now positioned as a leading gateway for corporate travelers connecting Europe, Asia, and the Middle East.

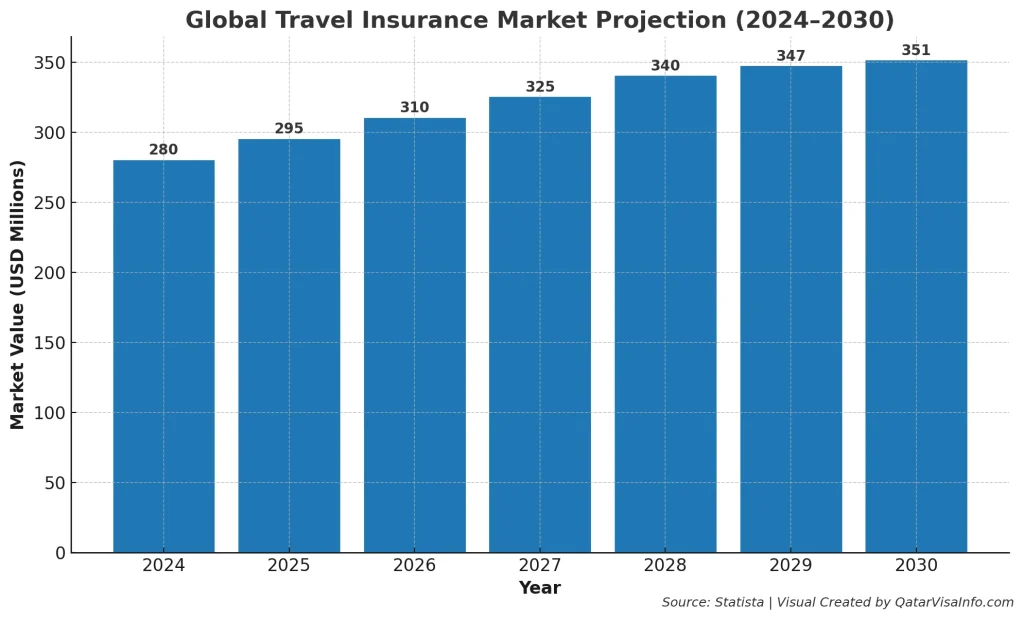

Qatar B2B travel market key Statistics and Projections up to 2030

The outlook for Qatar’s B2B travel sector remains highly promising. Industry forecasts indicate that:

- The market value is expected to reach approximately USD 351 million by 2030

- Demand for MICE (Meetings, Incentives, Conferences, and Exhibitions) travel continues to accelerate

- Business visitation and corporate spending are projected to grow steadily over the next decade

- Technology-driven travel management solutions will shape the future market landscape

What is the B2B Travel Market in Qatar?

The B2B (Business-to-Business) travel market refers to corporate and professional travel services arranged for companies, government bodies, and international organizations. Instead of individuals booking trips on their own, these travel activities are planned, managed, and paid for by businesses to support work-related objectives such as meetings, events, training, investment activities, and market expansion.

In Qatar, the B2B travel segment plays a critical role in strengthening international collaborations and enabling high-value business operations across industries like oil & gas, real estate, finance, and technology. Corporate travel management companies, airlines, hospitality groups, and service providers all contribute to delivering seamless travel experiences that match executive expectations.

Scope

Qatar’s B2B travel market covers a wide range of services, including:

- Corporate flight bookings and premium travel services

- Accommodation solutions for business travellers

- MICE services – Meetings, Incentives, Conferences, Exhibitions

- Trade delegation and investor visits

- Ground transport, visa support & travel compliance

- Travel management technology platforms

- VIP and executive travel solutions

The goal is to ensure efficiency, comfort, and cost control while helping organizations maintain global operations and business networking.

Difference From Leisure Travel Segment

| Aspect | B2B Travel | Leisure Travel |

| Purpose | Business tasks, corporate goals, events, investor relations | Holidays, relaxation, entertainment |

| Decision Maker | Company or employer | Individual traveler |

| Budget | Often higher, focused on value & convenience | Varies by personal preference |

| Travel Style | Premium services, flexible schedules, short stays | Longer stays, tourism attractions |

| Services Needed | Airport transfers, meeting facilities, compliance | Sightseeing, leisure tours, family services |

In simple terms:

➡ B2B travel is business-driven and mission-focused

➡ Leisure travel is experience-driven and recreational

Market Overview & Current Trends

Qatar’s B2B travel landscape is evolving rapidly as the country continues to strengthen its position as a business and investment hub in the Middle East. Corporate travel volumes have rebounded strongly, supported by increased international engagement, growing business clusters, and enhanced hospitality infrastructure.

Below are the major current trends reshaping the sector:

Post-World Cup Tourism Boost

The global exposure gained during the FIFA World Cup 2022 has created long-term benefits for business travel. Qatar showcased its ability to host major international events, leading to:

- Higher inflows of corporate delegations and investors

- Greater confidence in Qatar’s event management capabilities

- Expansion in hospitality and premium travel services

This momentum continues to fuel recurring business visits and new trade partnerships.

Digital Transformation in Corporate Travel

The adoption of smart travel solutions is accelerating across corporate sectors. Companies now prefer technology-first travel management services to improve:

- Real-time booking visibility

- Policy compliance & cost-control

- Traveler safety and tracking

- Integration with business workflows

AI-powered travel platforms, contactless services, and digital approvals are becoming essential as organizations seek more efficiency and transparency.

Increasing Demand for MICE and Business Conferences

Qatar is emerging as a competitive destination for MICE (Meetings, Incentives, Conferences, and Exhibitions). This demand is driven by:

- Purpose-built venues like Doha Exhibition & Convention Center

- Landmark global events such as Web Summit Qatar

- Strong government support for trade exhibitions and conventions

As more global brands and organizations choose Qatar for high-level events, corporate travel spending and bookings are expected to grow even further.

Emerging Trends Transforming Qatar’s B2B Travel Market

Qatar’s business travel sector is evolving rapidly as companies adopt smarter, more efficient, and more sustainable mobility practices. Key transformation drivers include:

Smart Travel Technology

AI-driven travel management platforms, digital identity verification, and blockchain-based compliance solutions are helping corporates streamline bookings, expenses, and safety protocols while ensuring seamless executive experiences.

Sustainable Corporate Travel

Companies increasingly prioritize eco-friendly options aligned with Qatar National Vision 2030, including:

- Carbon-neutral hotels

- Green mobility solutions

- Energy-efficient smart city venues like Lusail

This sustainability shift is becoming a crucial decision-making factor.

Hybrid and Tech-Enabled MICE Events

Post-pandemic recovery has brought an era of hybrid conferences that blend physical participation with real-time digital engagement. This boosts demand for smart venues equipped with advanced AV and live-streaming support in business districts such as West Bay.

Focus on Executive Wellness and Premium Services

Luxury hospitality, airport wellness lounges, priority flight services, and concierge-based travel planning are gaining importance — particularly among C-suite travelers and global delegations.

Market Size and Growth Outlook

Qatar’s B2B travel market is on a clear upward trajectory as the nation continues to expand its economic partnerships and attract high-value corporate activity. Growth is being sustained by continuous infrastructure development, business-friendly policies, and a stronger international travel network connecting Qatar with key markets across the globe.

Market Valuation & CAGR Projections

Industry forecasts suggest that the market will:

- Reach nearly USD 351 million by 2030

- Maintain a steady annual growth rate (CAGR) over the forecast period

- See consistent increases in expenditure from both regional and international corporate travellers

This growth outlook reflects Qatar’s strengthening role as a global platform for finance, trade, technology, and major event hosting.

According to a recent market analysis from a global research firm, Qatar’s B2B travel sector was valued at around USD 232 million in 2023, with projections indicating strong growth reaching USD 351 million by 2030. Independent assessments from advisory groups further confirm that increasing business travel spending and expanding hospitality infrastructure will drive steady market expansion throughout the decade.

Main Growth Expectations up to 2030

Several important trends are expected to fuel market expansion:

- Greater corporate mobility as businesses expand operations and investments

- Higher spending on executive travel services, including premium transportation and accommodation

- Growth in MICE tourism, supported by regular global exhibitions and summits

- Enhanced digital travel systems, helping organizations optimize travel management

- Rise in cross-border collaborations with GCC, European, and Asia-Pacific companies

Market Dynamics and Key Drivers

Qatar’s B2B travel sector is thriving due to strong policy support, global connectivity, and rising economic activities across multiple industries. As Qatar positions itself as a competitive hub for global business, several key drivers are accelerating the growth trajectory of the corporate travel market.

Key Market Drivers Identified in the Report

Economic Diversification

Qatar National Vision 2030 continues to guide the country’s shift from an energy-dependent economy to a broader business ecosystem. New investments across finance, technology, logistics, and real estate are creating frequent travel needs for executives, investors, and project teams.

Aviation & Airport Expansion

Hamad International Airport’s world-class upgrades — along with Qatar Airways’ expanding global routes — help facilitate smooth travel to more than 170 international destinations. Enhanced air connectivity ensures faster, premium access for business travelers worldwide.

Leading consultancy insights highlight that Qatar’s continued investment in smart business districts, convention facilities, and high-end hotels — particularly around Lusail and West Bay — is significantly enhancing its attractiveness as a corporate travel destination. Analysts emphasize that these hospitality and transport upgrades are helping Qatar secure long-term competitiveness within the GCC’s rapidly evolving business tourism market.

Foreign Investment & Multinational Presence

With companies from Europe, Asia, and the US expanding into Qatar, corporate visits related to market entry, stakeholder meetings, and employee relocation continue to grow. This increasing multinational footprint directly boosts demand for B2B travel services.

Tourism Infrastructure Upgrade

The development of smart business districts, luxury hotels, convention centers, and integrated transport systems is creating a travel experience tailored for high-level corporate clients. These upgrades ensure high comfort, convenience, and service quality.

Business Partnerships & Trade Events

Qatar regularly hosts regional and global business events, including conferences, exhibitions, investor forums, and trade shows. Such platforms encourage international networking and stimulate recurring travel from different industry stakeholders.

Restraints & Challenges

While the outlook for Qatar’s B2B travel market remains positive, there are several challenges that could influence growth in the coming years:

Price Sensitivity for Corporate Travel

Many organizations operate with strict travel budgets and require cost-efficient solutions. Premium services in Qatar — particularly in hospitality and transportation — can be higher-priced compared to other business hubs, prompting companies to seek more economical alternatives or negotiate tighter travel policies.

Travel Regulations and Compliance

Corporate travel often involves visa requirements, documentation, and adherence to security protocols. For some industries and international companies, regulatory processes may add complexity or delay travel planning, impacting overall mobility and scheduling.

Competition from Regional Markets (UAE, Saudi Arabia)

Nearby GCC nations, especially Dubai in the UAE and Riyadh in Saudi Arabia, are aggressively expanding their corporate travel and MICE capabilities. Their established global presence, event infrastructure, and branding create competitive pressure as they attract similar business traveler demographics.

Market Segmentation Highlights

The Qatar B2B travel market is diversified across multiple travel categories and service offerings, each contributing differently to overall market expansion. Below is a breakdown of key segmentation areas shaping demand in the sector:

By Travel Type

Corporate Managed Travel

This segment includes planned travel for employees, executives, and corporate teams. Companies partner with travel management providers to ensure efficient arrangements, policy compliance, and cost control. It represents the largest share of the B2B travel market.

MICE Travel (Meetings, Incentives, Conferences & Exhibitions)

Driven by Qatar’s emergence as a major event destination, MICE travel continues to grow strongly. Large-scale forums, business expos, and corporate incentive trips stimulate frequent high-value travel.

Trade Delegation Travel

Business delegations and investor groups regularly visit Qatar to explore opportunities in sectors such as energy, finance, construction, and technology. These official and commercial mission trips create a steady source of corporate travel demand.

By Service Type

Accommodation & Hotels

Premium and business-grade hotels represent a major segment as Qatar offers luxury brands, executive suites, and integrated meeting facilities catering to corporate clients.

Flight & Transportation Services

Air travel forms the backbone of Qatar’s corporate mobility, supported by Qatar Airways’ vast network and enhanced ground transport systems designed for business convenience.

Travel Management Technology

Digital platforms are redefining business travel through automated bookings, expense tracking, and real-time approvals—making travel more efficient for organizations.

Risk & Compliance Solutions

Companies prioritize traveler safety and regulatory compliance. Services supporting visa requirements, insurance policies, and corporate duty-of-care strategies are seeing increased adoption.

By Industry Vertical

Qatar’s B2B travel demand is closely tied to the performance and expansion of its major industries. The following sectors play a leading role in shaping corporate travel trends:

Oil & Gas

As the backbone of Qatar’s economy and a major driver of international partnerships, the oil and gas sector generates significant executive travel activity. Frequent business negotiations, technical collaborations, and workforce mobility keep travel needs consistently high.

Banking & Finance

With Doha emerging as a regional financial hub, global banks, investment firms, and fintech companies regularly engage in networking, compliance meetings, and cross-border project coordination—fueling steady corporate travel requirements.

ICT & Technology

Qatar’s advancement in smart infrastructure, cybersecurity, and innovation accelerates business travel from technology experts, global IT vendors, and startups. The push toward a digital economy further expands this segment’s travel footprint.

Healthcare & Logistics

Healthcare expansion, medical collaborations, and supply chain projects bring international specialists and logistics teams into the country. Travel activities include training, facility development, and service integration across networks.

Construction & Real Estate

Mega projects, including industrial zones, high-rise business districts, and smart city developments, require continuous site visits, procurement trips, and contractor coordination—maintaining strong demand for corporate mobility.

Regional Insights

Qatar’s B2B travel activity is primarily driven by its major commercial centers, supported by advanced aviation and transportation networks. The regions highlighted below play a crucial role in shaping corporate travel trends across the country.

Doha Market Dominance

Doha remains the central hub for business travel as it hosts the majority of financial institutions, government ministries, multinational companies, and major event venues. Most corporate meetings, trade exhibitions, and industry gatherings take place in the capital, ensuring high demand for premium accommodation and travel services.

Lusail & West Bay Business Hubs

- Lusail City is rapidly expanding as a futuristic business district with headquarters, mixed-use developments, and conference facilities—attracting global investors and professional teams.

- West Bay remains a key location for high-end corporate offices, luxury hotels, and diplomatic establishments.

Both areas contribute to a growing need for executive travel planning and short-stay business visits.

International Connectivity Through Qatar Airways & HIA

Hamad International Airport (HIA), recognized among the world’s top airports, serves as the primary gateway for international corporate travel. Its seamless operations, premium lounges, and global flight network enable fast access to key business continents.

Qatar Airways further strengthens this mobility through:

- Extensive connectivity to over 170 destinations

- Specialized corporate travel programs

- High service standards and flexible scheduling

Competitive Landscape

Qatar’s B2B travel market is supported by a mix of local and international travel management companies, airlines, hotel groups, and digital solution providers. As competition intensifies, businesses are focusing on personalization, technology, and high-end corporate services to maintain market advantage.

Overview of Key Players & Travel Management Companies

Leading players in the industry include established travel agencies, global corporate travel firms, and specialized MICE organizers. These companies serve enterprises from energy, finance, technology, and logistics sectors, providing comprehensive business travel planning and executive support services.

Innovation Strategies & Service Differentiation

To stand out in a rapidly developing market, companies are:

- Offering end-to-end managed travel packages

- Introducing VIP and luxury travel services for executives

- Providing dedicated onsite support for conferences and events

- Building exclusive hospitality partnerships with premium hotels

This shift toward high-quality service delivery aligns with Qatar’s positioning as a luxury business destination.

Technology & Data-Driven Solutions Shaping Competition

Digital transformation is becoming a core competitive strategy. Travel management providers are adopting:

- AI-powered booking systems

- Expense and policy automation

- Real-time traveler monitoring tools

- Predictive analytics for cost optimization

These innovations improve efficiency and transparency — both are crucial factors for corporate clients when selecting travel partners.

Opportunities and Future Outlook

Qatar’s B2B travel market is expected to see sustained growth as global business activity expands across the region. Several future-focused opportunities are emerging for the sector:

Growth of Corporate Events and Exhibitions

The country continues to host major global summits, trade expos, and industry conferences, creating regular influxes of decision-makers and business travelers. Continued investment in convention centers and event tourism will further boost the MICE segment.

Partnership Potential with GCC & Global Markets

Cross-border cooperation is increasing through:

- Regional business alliances

- International trade missions

- Multinational corporate expansions into Qatar

This rising global connectivity will keep demand for business-oriented travel services on the rise.

Role of High-End Hospitality and Smart Services

Qatar’s premium hotel brands, smart mobility solutions, and luxury travel offerings give it a strong competitive edge in executive travel. As business expectations evolve, the market will benefit from:

- Technologically enhanced visitor experiences

- Bespoke corporate service models

- Integrated travel and accommodation solutions

COVID-19 Impact and Recovery Trends

The Qatar B2B travel market, like the global corporate travel industry, experienced a temporary decline during the COVID-19 pandemic due to travel restrictions, remote work adoption, and postponed business events. However, Qatar responded quickly with strong safety measures and aviation-led recovery strategies.

Business Travel Slowdown & Rebound

- During 2020–2021, corporate travel spending fell significantly as meetings shifted to virtual channels.

- The reopening of international routes and major event preparations sparked a strong rebound from late 2022 onwards — especially following the FIFA World Cup, which restored global mobility confidence.

Today, corporate travel volumes are steadily increasing as companies return to face-to-face networking, site inspections, and investment activities.

Safety Upgrades and Digital Health Screening

Qatar implemented advanced systems that helped accelerate safe travel recovery:

- Digital vaccination and testing verification

- Contactless airport processes

- Enhanced sanitization and upgraded medical facilities at terminals

- AI-driven monitoring of passenger flows at HIA

These improvements have strengthened traveler trust and set a foundation for smarter, more resilient corporate travel operations.

Why Qatar is Emerging as a Leading GCC Business Travel Hub

Qatar has positioned itself as a major competitor among regional business destinations, supported by visionary reforms and world-class transport infrastructure.

Business-Friendly Environment

Government-driven policies prioritize ease of doing business by promoting:

- Fast regulatory approvals

- Investor protection measures

- Visa reforms encouraging global workforce mobility

Corporate visitors experience strong institutional support, making Qatar a preferred choice for strategic business expansions.

New Economic Zones and Investment Policies

Specialized zones such as Qatar Financial Centre (QFC), Qatar Free Zones Authority (QFZA), and Lusail’s business districts attract multinational firms with:

- Tax benefits and foreign ownership opportunities

- Access to modern facilities and logistics connectivity

- Innovation-driven ecosystems for emerging industries

These zones generate continuous corporate visitor flows for administrative functions, project planning, and market evaluations.

International Market Connectivity

Qatar’s global reach is strengthened by:

- Qatar Airways’ extensive international network

- Hamad International Airport’s globally recognized service excellence

- Strategic geographic location between Europe, Asia & Africa

This seamless connectivity reduces travel time and enhances Qatar’s attractiveness for global business mobility.

Conclusion

Qatar’s corporate travel sector is on a strong upward trajectory, supported by strategic national policies and world-class infrastructure. The continued expansion of Qatar Airways, cutting-edge hospitality developments, and the rise of major business events and exhibitions are fueling the industry’s momentum. As Qatar diversifies beyond oil and gas, new business opportunities in technology, finance, and logistics are drawing more global travelers into the country.

With its business-friendly environment, resilient recovery from global disruptions, and strong international connectivity, Qatar is well-positioned to become one of the leading corporate travel hubs in the region.

What is the B2B travel market in Qatar?

The B2B travel market includes corporate travel services such as business trips, meetings, events, trade delegations, and travel management solutions for companies operating in Qatar.

Why is Qatar becoming a major business travel destination?

Qatar offers strong global air connectivity, a business-friendly environment, advanced infrastructure, special economic zones, and a growing presence of multinational companies.

Which industries drive business travel demand in Qatar?

Major demand comes from oil & gas, banking, ICT & technology, construction, real estate, and healthcare logistics.

How did COVID-19 impact the corporate travel market in Qatar?

Business travel slowed due to restrictions, but strong recovery began with digital health screening, hygiene upgrades, and the return of global conferences and corporate events.

What role does Qatar Airways play in business travel growth?

Qatar Airways and Hamad International Airport boost connectivity to over 170 destinations, making Qatar a strategic hub for international trade and executive travel.

What opportunities exist for travel providers in Qatar?

High-end hospitality, smart travel management technology, and increasing corporate events provide significant business opportunities for travel agencies and service providers.

What challenges affect corporate travel in Qatar?

Price sensitivity, regulatory compliance, and strong competition from neighboring markets like UAE and Saudi Arabia are key constraints.

Will Qatar’s business travel market remain profitable in the long term?

Yes — continuous government investments, foreign business partnerships, and strategic sectors support sustained profitability and long-term market expansion.

Which areas in Qatar attract the most business travelers?

Doha dominates due to commercial venues, while Lusail and West Bay are rapidly becoming major hubs for corporate events and multinational offices.